Kelly Criterion Formula

The Kelly Criterion has come to be accepted as one of the most useful staking methods for sharp bettors. While most of us think we have an understanding of the Kelly Criterion and how it works, this is merely a simplified version of the formula. Our latest Guest Contributor has provided an in-depth explanation of the “real” Kelly Criterion. Read on to learn more.

Anyone who is unfamiliar with how the Kelly Criterion can be used to determine optimal bet sizes should read Dominic Cortis’ article on how to use the Kelly Criterion for betting. This approach works well in most cases, however, there are some situations where the Kelly Criterion formula can give some head-scratching results.

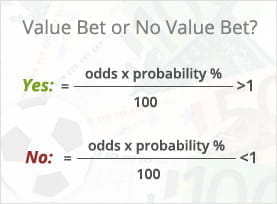

The Kelly Criterion. Developed by John Kelly, who worked at Bell labs, the Kelly Formula was created to help calculate the optimal fraction of capital to allocate on a favorable bet. The great thing about the formula is that it’s flexible enough to work where information or skills can give you an advantage by estimating the outcome probabilities. Oct 05, 2020 The Kelly Criterion is a formula used to bet a preset fraction of an account. It can seem counterintuitive in real time. The Kelly formula is: Kelly% = W – (1-W)/R where: Kelly% = percentage of capital to be put into a single trade. W = Historical winning percentage of a trading system. R = Historical Average Win/Loss ratio.

Apr 09, 2019 The Kelly Criterion is a formula which accepts known probabilities and payoffs as inputs and outputs the proportion of total wealth to bet in order to achieve the maximum growth rate. Kelly Criterion.

- Kelly Criterion Excel Spreadsheet. We've developed a Kelly Criterion formula Excel spreadsheet that you can download here. It's free and easy to use. Simply input your betting bankroll, the odds on offer, your assessed probability for that outcome occurring and your Kelly fraction.

- Mar 27, 2015 Kelly’s criterion is a good start, but it’s not the full picture. If you visualize the relationship between balance growth and the% of risk, it will look like this: From here we can witness the same pattern as we noticed before – to the left of one Kelly return increases as you increase risk.

Using the examples below, we can examine the potential flaws in using a simplified Kelly Criterion formula.

Example #1 - A soccer game where both a visitor win and draw outcome provide the bettor with an edge:

The Kelly formula would suggest staking 2.5% of bankroll on both the visitor win and the draw, staking a total of 5% of bankroll. Looking at the Handicap odds for the same soccer game changes how we might view the use of the Kelly Criterion.

Example #1A - The same soccer game in example 1 re-stated as a Handicap line:

A bet on the visitor +0.5 at odds of 2.50 is the equivalent to betting half the amount on both the visitor win and draw (both at odds of 5.00). So why does the Kelly formula give a different answer?

The answer is that the formula commonly known as the Kelly Criterion is not the real Kelly Criterion - it is a simplified form that works when there is only one bet at a time.

How to use the “real” or generalised Kelly Criterion

Below is an explanation of how to apply the generalised Kelly Criterion to betting:

Step - 1: List all possible outcomes for the entire set of bets.

Step - 2: Calculate the probability of each outcome.

Step - 3: For each possible outcome, calculate the ending bankroll for that outcome (starting bankroll plus all wins minus all losses). Leave the bet amounts as variables.

Step - 4: Take the logarithm of each ending bankroll from step 3.

Step - 5: Calculate the weighted average of the logarithms from step 4, weighted by the probabilities from step 2. Call this the “objective”.

Step - 6: Find the set of bets that maximises the objective from step 5. These are the optimal bets according to the Kelly Criterion.

In order to find the set of bets that maximises the objective, simply use Microsoft Excel’s built-in “solver” module (see below) - this takes care of the complexities of advanced calculus and eliminates a tedious trial-and-error approach.

The result from using these six steps is as follows:

Note that this is identical to the result in Example #1A, where the simplified version of the Kelly Criterion does work. By making two mutually exclusive bets on the same game, the two bets act as a partial hedge for each other – reducing the overall level of risk, which Kelly rewards by increasing the bet amount (compared to the calculation in Example #1).

Additional uses from the generalised Kelly Criterion

Kelly Criterion Formula For Excel

We have already seen how this generalised Kelly Criterion can produce completely different results than the simplified Kelly formula that most bettors will use when there are multiple edges in the same game.

There are, of course, occasions when you might have multiple edges on different games, all taking place at the same time. The example below is one such situation:

Kelly Criterion Formula

Example #2 - Betting with an edge on four separate games that are all taking place at the same time.

Now while each of these bets make sense individually, using the simplified Kelly Criterion would result in staking 110% of bankroll - something that clearly doesn’t make sense. However, by applying the six steps stated above, we can see how the generalised Kelly Criterion produces a different set of results.

Because the four games are independent, the probability of each outcome can be calculated as the product of the probabilities of each game; for example, the first row probability would be calculated as:

In additional to calculating the optimal staking amount for a bet with multiple edges, the generalised Kelly Criterion can also be used when bettors have a viable hedging opportunity.

Example #3 - Hedging Garbine Muguruza to win Wimbledon in 2015.

Using the 2015 Wimbledon tournament example previously used in this hedging article, we can see how the generalised Kelly Criterion should be applied to a hedging opportunity.

Kelly Criterion Formula Python

If you had €1,000 starting bankroll, and you bet €10 on Muguruza at 41.00 to win Wimbledon 2015 outright, you would have to decide how much to hedge on Williams at 1.85 in the final. Let’s assume that the odds in the final are efficient, that is, they accurately reflect each outcome’s probability so that there is no edge on either side.

The more commonly used simplified Kelly formula would provide the following results in the scenario:

However, applying the generalised Kelly procedure as stated above yields the results below:

Kelly Criterion Formula Stocks

Using this method shows that optimal strategy would be to bet €183.41 on Williams at 1.85 to beat Murguruza in the final and win the tournament - this will hedge most, but not all, of your open position on Murguruza to win the tournament.

Kelly Criterion Formula Trading

Taking the exponential of the objective gives an interesting number, called the “certainty equivalent”. In Example #3 above, the certainty equivalent is exp(7.072341) = 1,178.90. This means that, from a Kelly Criterion perspective, the bettor would be indifferent between having the listed set of bets and having €1,178.90 in risk-free cash.

If we remove the hedge bet, we are left with the following:

So, the effect of the hedge bet is to raise the certainty equivalent from €1,166.87 to €1,178.90. So even though the hedge bet itself has a negative expected value, the resulting reduction in risk is so beneficial that from a Kelly perspective, it has created added value that’s equivalent to €12.03 in cash.

Some other applications of Generalised Kelly

- Finding optimal bet sizes for a set of “round robin” combinations of parlays or teasers;

- Finding optimal bet sizes for a set of futures bets on several different teams to win the same division or championship;

- Deciding between different ways to hedge an existing bet (money line, spread, buying/selling points), especially if some options result in a “middle” opportunity;

- Figuring out how much to add to, or exit from, an existing position after a line move.

Use the real Kelly Criterion to empower your betting - get the lowest margins and highest limits online at Pinnacle.

Kelly Criterion Formula For Horse Racing

This Guest Contribution was made by on of our Twitter followers - @PlusEVAnalytics. If you would like to make your own contribution, contact us on Twitter or email us.